Which Debt Should You Pay First? Road To Being Debt Free

- ValueChampion

- Finance , Lifestyle , Singapore , Travel

- July 21, 2021

If you are struggling to clear your debt, use these methods and strategies to become debt-free.

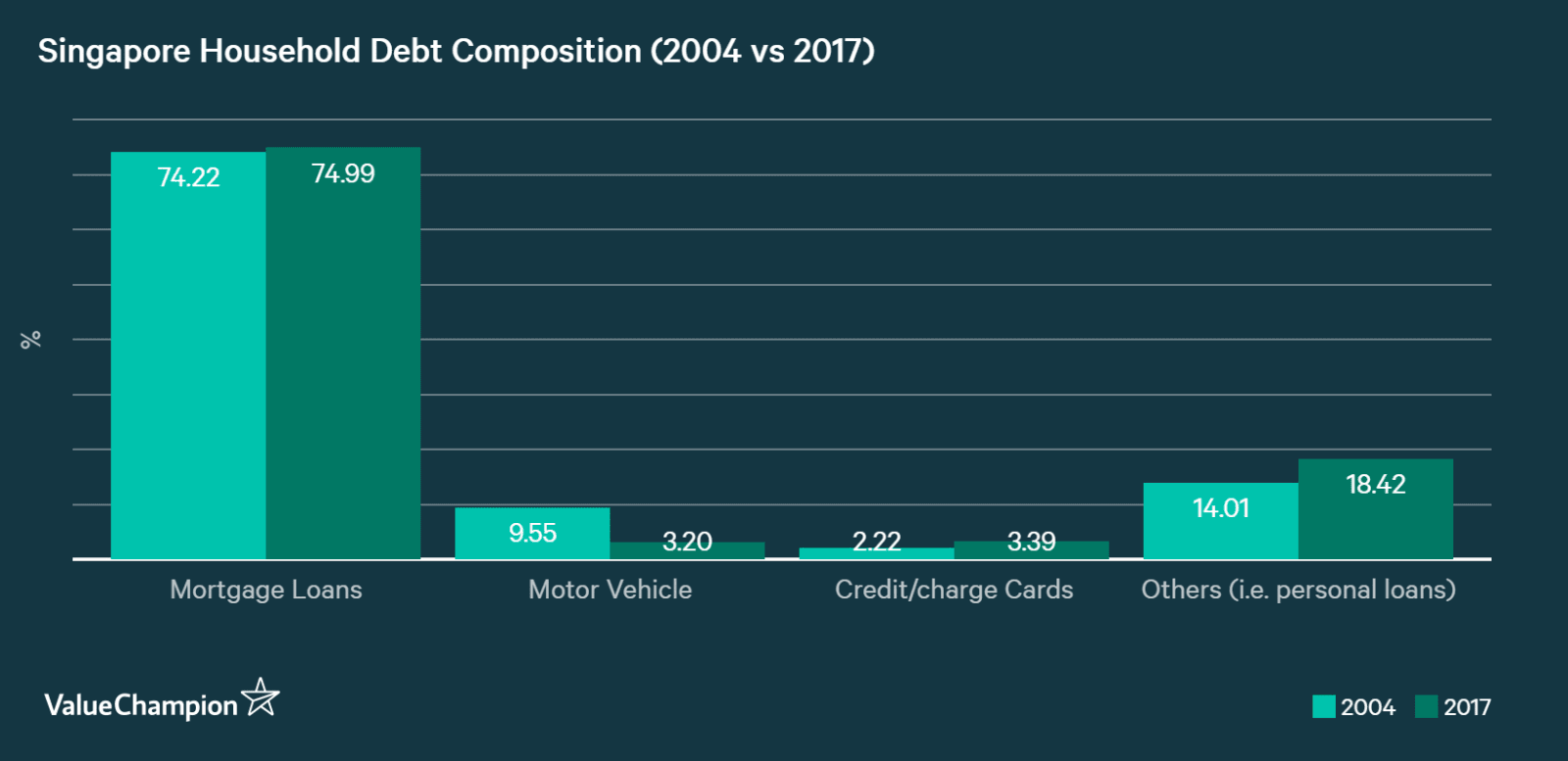

Paying off debt isn’t easy. Many of us have struggled only to pay the minimum amount each month or found ourselves surrounded by multiple sources of debt. Singaporeans have more access to different lines of finance than ever before, and the average household debt in 2017 per capita was S$57,637.

Remember, not all your debt is the same. Before plugging any holes in your finances with bundles of your hard-earned cash, slow down and figure out which debt is hurting you the most.

Build an Emergency Savings Fund

Before you begin implementing any strategy, you will want to save a small emergency fund while making minimum payments towards your debts. Although it may seem counterintuitive to not pay off your debts immediately, an emergency fund is your financial insurance package. In the event of an emergency, you now have a cushion to pay off those expenses without running yourself further into debt.

Once you’ve managed to build a small emergency fund, you can begin implementing your strategy to clear the debt.

Organize Your Debt

There are two competing strategies to clear multiple outstanding balances: the debt avalanche and debt snowball methods. Both methods are techniques you can apply to your personal finances to tackle a range of different types of debt. What they both have in common is sitting down and listing out all of your debts—then prioritizing the one that hurts the most (i.e. interest, or one with greater penalties). The idea is you make minimum payments on all loans except one. You then apply as much extra money toward making large payments to erase the debt.

Although the methods differ in which debt you single out to pay, both ways are reasonable approaches to tackling multiple debts. Before deciding, research the pros and cons of both methods and choose which one is best for you. You can also look at debt consolidation plans and balance transfer options to transfer high-interest debt into low-interest accounts to tackle your outstanding debt aggressively.

High Interest Loans

Surrounded by consumer debt with high-interest rates can feel like you are drowning. One of the largest sources of consumer debt is your home loan. Thankfully, this type of debt is what we call a secured loan backed by an asset (the home) and comes with lower interest rates. While on the other hand, unsecured loans, like credit cards and personal loans, tend to go with much higher interest rates.

The bottom line is that the higher interest rates you have, the higher the total cost of the loan becomes. Lending toward the debt avalanche method, after you’ve taken the time to organize which types of debt you have, the advantage of tackling your highest interest rates first can save you money in the long run. The challenge is that it isn’t easy to stay the course. Paying large sums of your principal balance to clear your high-interest debt will require some discipline. However, you can directly measure the debt avalanche method in dollars saved.

Government Debt

Most Singaporeans pay their taxes on time, but if you find yourself struggling one year, you will want to prioritise this debt as soon as possible. Penalties can be immediately applied and the government will eventually take enforcement actions to recover taxes. In some instances, you will be unable to access your bank accounts until they receive full payment. Worse yet, the government can even take legal action against you.

So when organizing your debt, one of the first things to resolve is debt owed to the Singapore government. You shouldn’t be too worried, you can apply for up to 12 interest-free monthly instalments via GIRO to manage payments, but the worst thing you can do is neglect it entirely.

This article was originally published in ValueChampion, a personal finance research firm in Singapore and republished on rovervibes.com with permission.