3 Ways To Save Money On Your Life Insurance

- ValueChampion

- Finance , Lifestyle , Singapore , Travel

- July 20, 2021

Life insurance provides financial protection to your loved ones, but it can sometimes come at a hefty cost. Read ahead to learn 3 ways to save money on your life insurance premiums.

There’s more to saving money on life insurance than annual discounts or seasonal promotions. In fact, one of the most effective ways to reduce your life insurance premium is by leading a life that reduces your chances of actually needing the lump-sum payout. It might be a no-brainer, but healthy people have access to the cheapest life insurance in Singapore. Whether you’re buying a plan for the first time or want to know how to reduce next year’s renewal costs, here’s 3 ways to bring down your premiums so that you aren’t paying an arm and a leg for your life insurance plan.

Don’t Hold Off On Buying Life Insurance

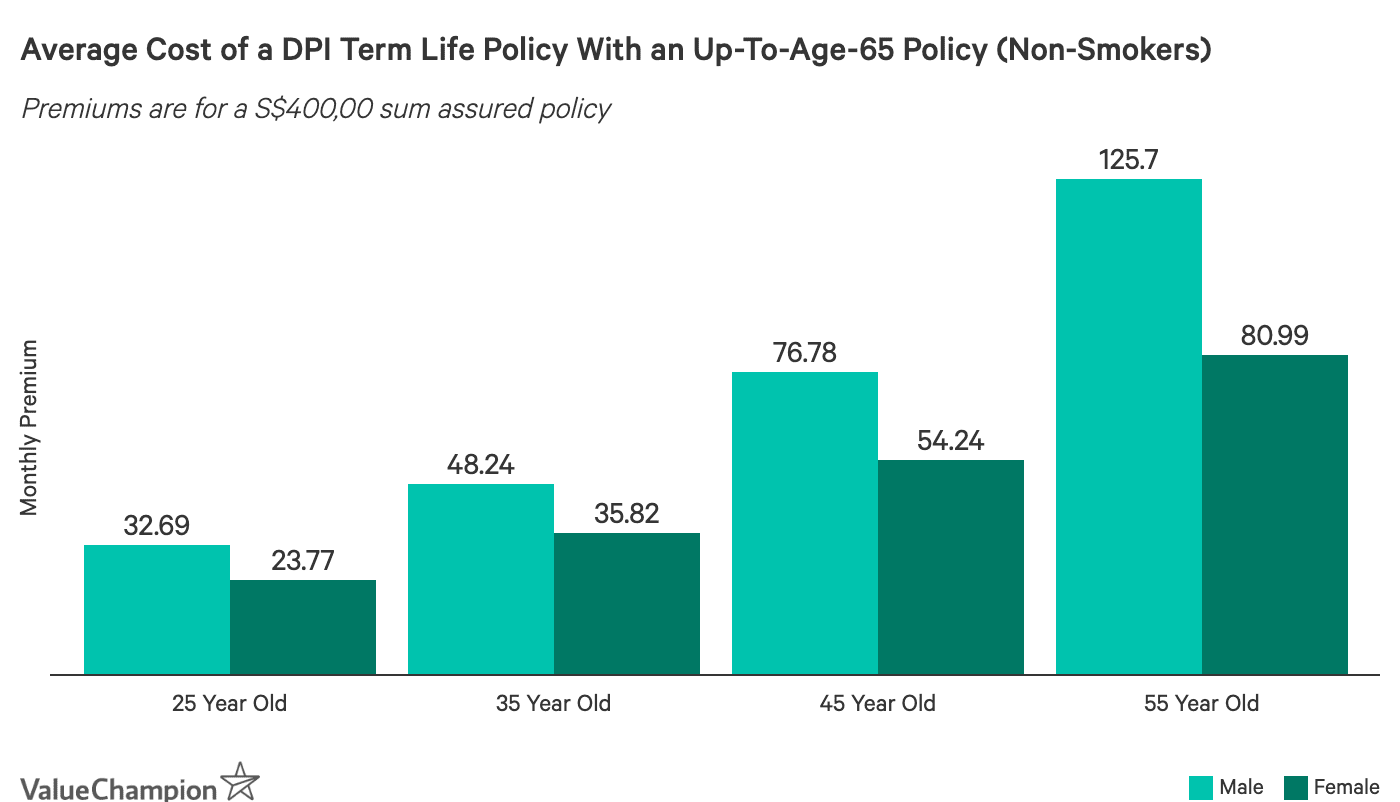

As a rule of thumb, younger adults will find the lowest premiums in the life insurance market. This is because health issues increase as you get older, and thus life insurance is more costly to account for pre-existing conditions and increased health risks. Furthermore, premiums are cheaper because you will be spreading out your policy over a longer period of time. If you’re in your late 20s or early 30s, now may be the best time to buy a life insurance plan to maximise coverage at the lowest costs.

When it comes to monthly premiums, people in their 50s will pay between 241% and 285% more than people in their 20s. Even 35-year-olds see 48% to 51% higher premiums than 20-year-olds. Therefore, the best thing you can do to save money on life insurance is to lock in your premiums early and invest in a plan sooner than later.

Some young adults may not think that they need life insurance; however, accidents and illness can happen to anyone. With a life insurance plan, you can ensure that you leave your family or other beneficiaries with a financial safety net in the event of your disability or death. If you’re concerned about the higher costs of a whole life policy, a term life insurance plan may be a more suitable, cheaper alternative that can protect you during your working years.

Quit Smoking, It’ll Save Your Life and Money

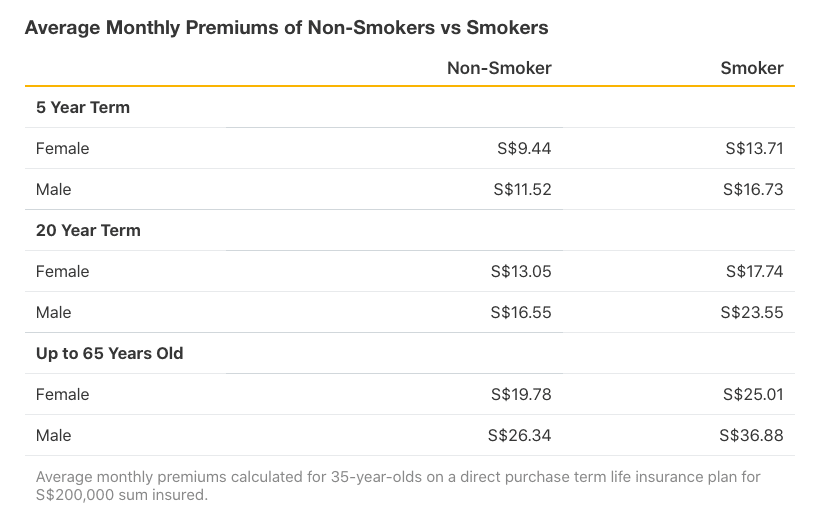

Smoking is a prime factor in determining your life insurance premium, due to the associated risks of cancer, stroke, and other major health issues. In fact, one of the first questions that providers will ask you is if you are a smoker. If the answer is yes, then you can expect to pay much higher premiums than those who don’t smoke. Thus, if you really want to save money on life insurance, you can start by re-evaluating your tobacco use.

Overall, a 35-year-old smoker will pay 38% more in premiums than a non-smoker. When it comes to a DPI plan up to the age of 65, non-smoking women in their 30s can expect to pay 21% less in monthly premiums than smoking women. Meanwhile, male non-smokers would pay 29% less than their smoking counterparts. While smoking increases rates for any smoker in question, the highest premiums fall onto men due to their higher risk of health issues like heart attacks (which is then exacerbated by tobacco use).

If you want to save this cost in life insurance premiums, you should seek out resources to help you quit smoking. Most providers require you to be tobacco-free for 12 months before you are eligible for non-smoker rates.

Maintain A Healthy Lifestyle

Chronic illness and high-risk lifestyles will also increase your life insurance premiums. While there’s probably not much you can immediately do about your favorite extreme hobbies or pre-existing conditions like asthma, there are other ways you can improve your health so that you are paying as little as possible in premiums.

For instance, if you have high levels of cholesterol or blood pressure related to weight, then healthy weight loss can benefit both your vitals, as well as your bank account as far as life insurance premiums go. However, maintaining a healthy lifestyle involves more than weight management. To improve your health, you should incorporate exercise, sleep, nutrition, and emotional wellbeing practices into your lifestyle.

Singapore has many resources to help you achieve your health and fitness goals. By taking advantage of these free guides, you can learn how to lead a healthy lifestyle, which will in turn help you manage or even improve some medical issues.

Start Your Health Journey Now and Thank Yourself Later

Whether you’re considering term life or whole life insurance, your age and health status will be huge factors in determining your monthly or annual premiums. Young adults and non-smokers will receive the cheapest rates because they are considered healthier and less likely to develop medical issues. But even if you are older or a smoker, it’s never too late to lead a healthier lifestyle. If you start now, you’ll thank yourself later for feeling better, but also saving money on medical costs, including life insurance.

This article was originally published in ValueChampion, a personal finance research firm in Singapore and republished on rovervibes.com with permission.